Bookkeeping might have a reputation for being dry and tedious, but it’s actually the backbone of a successful business, no matter its size. Without reliable and correct financial data, the business owners and managers can’t get a clear picture of how things are going and can’t make informed financial decisions.

Whether you’re still studying or you’ve just stepped into your first real-world bookkeeping job, it’s easy to get overwhelmed by the tasks involved. But don’t you worry – I’m here to make bookkeeping easy for you … and I love being organised in my work 🤭, so let me share with you the 4 distinctive steps that will make your bookkeeping life less stressful. This is not rocket-science at all. The steps I’m about to introduce are rather straightforward … and provide a clear structure to follow.

Let’s walk through each step.

Step 1: Gathering the financial documents

If you’re studying for your bookkeeping exam, all the information is usually provided to you. So, you don’t really need to worry about this step, hence you can skip this part and head straight to the next step.

However, if you’re doing actual bookkeeping, this is a step you cannot miss. Our job starts with collecting the source documents.

Why?

Because you can’t accurately record a transaction without understanding what it actually is. Recording should always be based on the exact nature of the transaction rather than how it was labelled.

What exactly are the financial source documents?

Easy … they are the primer documents of the transaction that verify the occurrence and nature of the transaction. They can be an invoice, a cheque, a credit note, a statement, a bankslip, a contract and so on.

Most importantly, they need to contain information about

- the date of the transaction,

- the participants of the transaction (eg. customer, vendor, employee),

- the details of the transaction (eg. products sold, services provided, loan description, asset specifics etc),

- the amount (including payment methods, fees and other costs, current and future obligations, etc.).

Remember, depending on your country’s regulations, there may be additional requirements for what is considered an acceptable source document, especially when taxes are involved. Make sure you’re aware of these and comply with them when dealing with financial documents.

Organising the source documents

Getting organised early on is critical, believe me. Filing the source documents is a must for audit trail, for future reference, and generally for not getting buried under piles of documents and folders. Principally, as a bookkeeper you need to adhere to the company’s filing hierarchy and practices.

If the business uses a cloud-based storage and a given folder structure, you’d better keep everything digital and neatly organised in the correct folders.

But if you’re in charge of setting up the filing system, my advice is to keep it simple and structure the documents around the bookkeeping process.

Step 2: Categorising the business transactions

Once you’ve gathered the documents, the next step is to categorize the transactions. This is arguably the most crucial part of bookkeeping because how you categorise transactions greatly impacts the output.

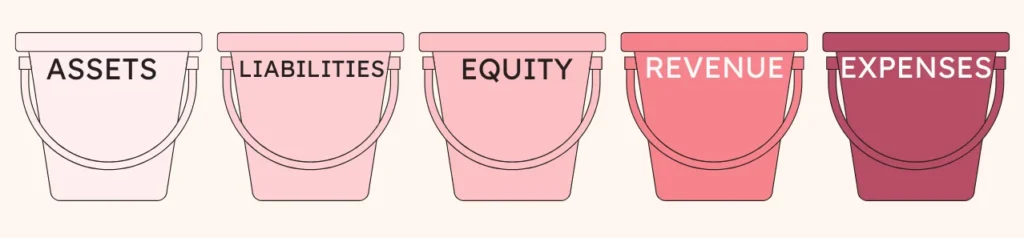

Based on source documents, you need to allocate the transaction into the correct category – or, as I rather see it, into the correct bucket. In bookkeeping, we use five main buckets:

- Assets

- Liabilities

- Equity

- Revenues

- Expenses

Each of these categories can have multitude of sub-buckets; the sub-buckets may have sub-sub-buckets and those can be broken up into sub-sub-sub-buckets … yes, I’m talking about the Chart of Accounts 😉.

Principally, every transaction needs to be assigned to one and only one (sub-sub-…) bucket. One particular (sub-sub-…) category contains similar transactions. For example rent would go under “Rent expense”, loan repayment would go under “Short term loan from ABC Bank” (that sits within Liabilities main bucket).

As a bookkeeper, you must familiarise yourself with the business’ Chart of Accounts and categorise the transactions using it.

Sometimes, the categorisation is quite obvious (for instance, when the business sells a product on credit), and other times it requires more consideration (whether we need to expense a tool purchased or to capitalise it as an asset purchase).

One of the common mistakes in bookkeeping is categorising all outgoing payments as expenses. Money was going out, so it needs to be an expense, right? NO!!! It could be many other things: a loan repayment, an asset purchase, a sales refund, just to name a few. All transactions must be carefully categorised to reflect the true financial position of the business.

So, take your time when categorising the transactions and ensure that – based on the available source documents – you allocate them to the correct bucket.

Step 3: Reconciling the transactions

Once all transactions are categorised, it’s time for reconciliation. Bookkeepers like using the “reconciliation” buzzword 😜, but what does it actually mean? 🤔

It’s pretty simple, to be honest.

Reconciling means that you’re comparing the accounts in your books to an external record, like a statement, to ensure everything matches up. If it does, you can be (almost) certain that you entered all transactions correctly and nothing was missed. However, if it doesn’t match, it’s a sign that something went wrong, and you’ll need to investigate further to find the cause of the discrepancy.

So, reconciliation, in reality, is double-checking your work. Most often, reconciliation is only limited to checking the bank statement to ensure that the bank balance on a given day is exactly the same in your records as in the actual bank account.

BUT reconciliation is not limited to bank accounts. You must reconcile ALL accounts you can to ensure their correctness. You can reconcile the accounts payable account based on the supplier’s statement, the loan account based on the loan account statement, and the payroll-related accounts based on the payroll data.

How often do you need to do reconciliation?

At a minimum, you should reconcile monthly or quarterly, but I recommend doing it as often as possible. Once you receive a statement, you do reconcile the data and if you find any discrepancy, work out the reason why there’s a difference, so that you can correct your records. This is a task you’d better not procrastinate. The sooner you spot an issue, the easier it is to fix. Trust me, it’s much less time-consuming and stressful to spot a mistake in one month’s worth of transactions than it is to go back through an entire quarter or year.

I consider the reconciliation process as the heart of bookkeeping. Continuously checking your work ensures accurate record-keeping and, hence, precise financial data that is the foundation for meaningful reporting.

Step 4: Preparing and reviewing financial statements

Financial statements are the output of our bookkeeping tasks. When all the transactions for a given period are processed and checked, and you’re confident that there are no errors in the records, you can prepare the financial statements. These are the reports that summarise all the transactions you’ve been recording, showing the financial health of the business.

And here I need to separate again:

- if you’re a student, this step may be challenging for you: closing the accounts, transferring the balances in the trial balance, making sure it does balance, and preparing the statements based on the trial balance. This is massive. But here’s the good news: when you pass your exam, you NEVER do financial statements manually ever.

- If you’re a practising bookkeeper, preparing financial statements is just a “press of a button”. In every accounting software, once you enter a transaction, you are able to generate the financial statements at once. It’s a no-brainer. Even if you’re doing bookkeeping in a spreadsheet, you probably have a template included for the financial statements that pulls data automatically from the accounts, so you don’t really create trial balances and manual financial statements anymore.

Therefore, reviewing the statements is more important to me in this step. As a bookkeeper, especially if you have just started, you do not need to analyse the financial performance and healthiness of the business. Of course, if you’re willing to do and have acquired the necessary skills, you can offer it as a value-add to your services.

The reason why I consider reviewing the financial statements essential for ALL bookkeepers is that it is another layer of checking your own work.

For instance, suppose your bank statements and credit card statements are reconciling, but you allocated a payment to a major subcontractor to “Utility expenses” by mistake. There’s no other way to recognise this mistake than looking at the income statement and noticing that something is odd and this business should not have these high utility expenses. Then you drill further and discover the misallocation.

There’s no direct recipe for how to review the financial statements. I always advise my students to look at the statements with fresh and open eyes and spot anything that is suspicious. I’m aware it’s too vague, but I cannot give you more precise instructions because the actual situation is always different. Whenever I do a review, I always look for the odd and outstanding figures and look into those to make sure that they’re correct. It takes practice and requires knowing the business you’re working for.

Key takeaways

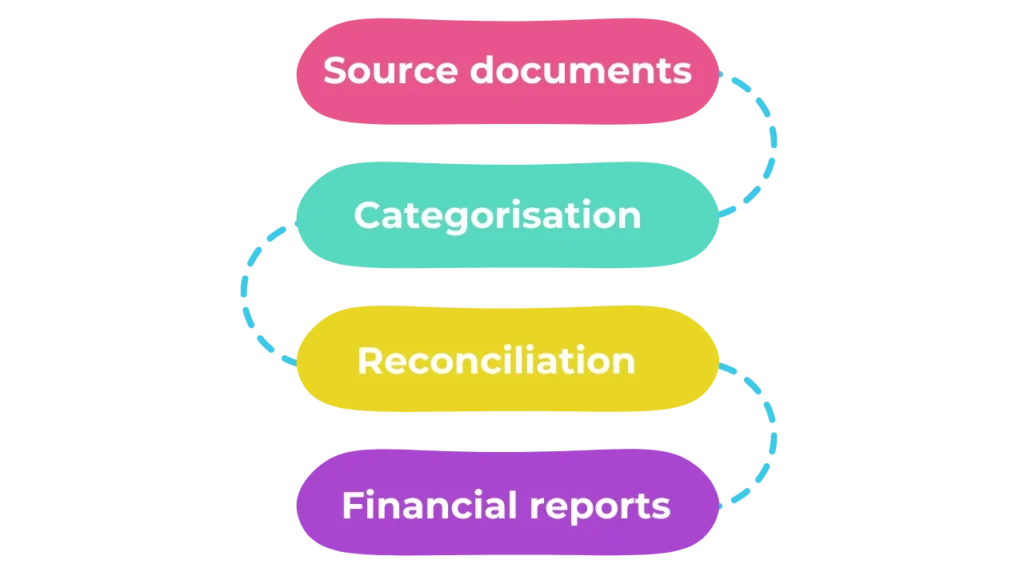

Bookkeeping is all about following a system. By breaking it down into these four steps, you can make the process more manageable regardless of the volume of transactions and the very specifics of the business:

- Step 1: Gathering the financial documents

- Step 2: Categorising the business transactions

- Step 3: Reconciling the transactions

- Step 4: Preparing and reviewing financial statements

If you focus on these steps, bookkeeping won’t feel so overwhelming. You need to get into habit to follow the process: source documents, categorisation, reconciliation and review the financial statements.

In fact, with enough practice, it’ll become second nature. Trust the process, and remember to double-check your work to ensure accuracy. Over time, you’ll find yourself becoming more confident and capable in your bookkeeping role.

I believe in You: you’re a champion 🏆

PS: If you’d like to learn more about the basics of bookkeeping, please check out the free Bookkeeping 101 mini-course by 👉 CLICKING HERE